This week, the Kansas Metropolis Chiefs introduced they have been relocating to the state of Kansas for a brand-new $3B stadium. The time period sheet agreed upon by the crew and state is outlandish. Joe Pompliano (who is among the finest at sports activities enterprise information) has gone over the time period sheet and claims it’s the “Most Lopsided Stadium Deal In NFL History” because of $1.8 billion in taxpayer cash being included. However the particulars of many vital components of the deal are nonetheless unknown. For instance, we nonetheless don’t know the place the brand new stadium will be located. In a current press convention, the Chiefs president claimed that the crew will resolve in a while the situation. The look of the stadium? The look of the leisure district across the stadium? Nothing. Heck, the crew hasn’t even employed an architect. But, even with loads of particulars nonetheless left unanswered, I discovered it odd that I continued to see the governor of Kansas go from media outlet to media outlet claiming that taxpayers someway have been protected with this deal.

“This settlement protects Kansas taxpayers, with the state’s portion coming from income generated by the stadium leisure venues and the STAR bond district, in addition to lottery funds” – Gov. Laura Kelly, 12/25/25, Kansas City Star

This remark drives me loopy. I can’t stand how usually this line is used. I’ve misplaced rely as to what number of instances I’ve seen articles the place metropolis/state leaders proclaim that native taxpayers gained’t pay a dime because of revenues from the venue getting used to pay for it. But, it not often pans out, and taxpayers are left to take care of the monetary penalties:

Cobb County, Georgia

In 2017, Cobb County satisfied the Atlanta Braves to maneuver to their metropolis by providing $300M in taxpayer cash to construct a brand-new ballpark. This deal was known as a “home run” by Cobb County leaders, who claimed that the “revenue generated by the stadium development would be so great that it would cover the costs to…taxpayers with plenty leftover to spare.” Years later, J.C. Bradbury, a professor of economics at Kennesaw State, printed a examine that concluded that the tax cash collected from the Braves’ transfer “fell well short of covering the public subsidies that fund the stadium.” This got here months after Bradbury wrote one other paper analyzing how the income generated by the brand new ballpark was not “statistically significant.”

Nashville, Tennessee

In 2013, the Nashville Sounds needed a brand new ballpark. The mayor proposed a deal that may value $37M, with $23M put aside for land prices. Then the prices rose to $65M as a result of crew demanding that any new ballpark needed to be built quickly. Either side agreed to a deal that noticed the town tackle $65M in debt. Metropolis leaders have been telling the general public that this deal would “pay for itself” because of it being financed with “tax revenues generated by the stadium.” What occurs if non-public improvement doesn’t occur across the stadium and due to this fact the revenues don’t come? Effectively, the mayor claimed to have a “high degree of confidence” that it’s going to occur, whereas the town finance director claimed that there was solely a “remote” probability that the revenues gained’t enhance over time. Unsure about you, however I positive am offered on this concept. A couple of years later, the full value of the mission ended up being near $100M, thanks partly to $21M value of tasks that the ballpark required but weren’t included within the finances. These new bills have been “paid for with existing Metro capital funds.” Earlier than the town agreed to the unique deal, the Sounds proprietor “promised (a) $50 million mixed-use development” that may assist the town repay the debt. “That still hasn’t been built yet.” Whoops.

Pawtucket, Rhode Island

In 2019, it was introduced {that a} new soccer stadium can be constructed with some taxpayer cash. The unique plan known as for the state of Rhode Island to “sell $27M in state and city bonds” to pay for the soccer stadium. However don’t worry, as the general public is not going to pay for this mission. As a substitute, cash will come from the “tax revenue generated by the project,” and that “would be used to pay back local and state bonds, including interest.” Then the prices of the mission went as much as $36M. Then $54M. Quick ahead to at present, and the price is…$128 million. What concerning the residential and business buildings that may be constructed across the new soccer stadium? Because the Rhode Island Present notes in an article, when the builders have been initially pitching lawmakers for cash, they promised a significant amount of recent buildings across the stadium. This could permit for extra income to be funded to the state. Nonetheless, the newest proposal by the builders contains simply two buildings and is taken into account a “substantial departure” from previous guarantees.

Columbus, Ohio

Between 1978 and 1997, voters have been requested to publicly fund new stadiums 5 instances. They rejected this proposal all five times. The final proposal was in 1997, and it might have allowed for the town to be given an NHL crew if it had handed. Subsequently, a bunch of buyers determined to finance the development of a new $150M stadium in order that the world might get an NHL crew. The lease settlement signed by the town and crew known as for the homeowners to be responsible for yearly lease funds and any working bills involving the venue. Ultimately, the homeowners complained that they weren’t making sufficient cash, so the town agreed to purchase the stadium from the homeowners. In 2011, the town bought the stadium for $53.3M. Taxpayers wouldn’t pay a dime because the complete value can be “funded entirely from casino-generated revenues” close to the stadium. Earlier than the on line casino revenues got to the homeowners, this cash was beforehand “earmarked for…improvements to public education, welfare programs, & civil services.” Overrated issues, imo. Simply three years later, the on line casino revenues have been “running dry” resulting from “lagged predictions” about how a lot the town would get from the on line casino taxes. So now, the town is put in a monetary place the place they’ve “little for improvements — and nothing to pay off the loans the authority used to purchase the arena.”

San Francisco, California

When San Francisco tried to get a brand new stadium inbuilt 2012, it was not straightforward. No one in San Francisco was keen to assist a billionaire proprietor finance his new stadium. So, the crew went out of the town and into Santa Clara. In 2012, Santa Clara leaders accepted plans to construct a brand-new stadium at a price of $878.6 million. The town agreed to take out a mortgage for $850 million that may “pay for most of (the new stadium)”. The town can be paid again “from revenue generated by the stadium.” Because the San Francisco Chronicle wrote, this deal was accomplished “without a direct public subsidy,” and due to this fact it was “possible to finance a new venue without a huge taxpayer subsidy.” In 2017, Robert Baumann, Victor Matheson, and Debra O’Connor wrote a paper for the Faculty of Holy Cross on Levi Stadium. In it, they wrote that whereas the development of the stadium “resulted in no direct tax will increase,” it did permit for the crew to “avoid many types of taxes on the income generated from Levi’s Stadium.” This resulted within the crew saving up to $213M.

Worcester, Massachusetts

In 2018, the town of Worcester agreed to construct a brand new ballpark for a Crimson Sox minor league crew at a price to taxpayers of $101M. Metropolis leaders “hailed (the) plan” as a “sport changer” as a result of taxpayers weren’t going to pay a dime. The town negotiator acknowledged that the income generated by and outdoors the ballpark “will cover the debt…and even turn a profit (for the city).” The town negotiator claimed that different cities used this fee methodology and it labored nice for them (but we by no means discovered who these cities have been). WBUR wrote an article that detailed different cities that used this fee scheme, and it appears to have failed miserably nearly each time. A couple of months in the past, MassLive wrote an article on this matter and located that “for the second year in a row, revenue collected from the development district around Polar Park in Worcester has come up short to pay the stadium’s construction debt.” On this particular case, we’ve got builders who’re simply not doing what they promised to do, and the town has little recourse to drive them into ending what they acknowledged.

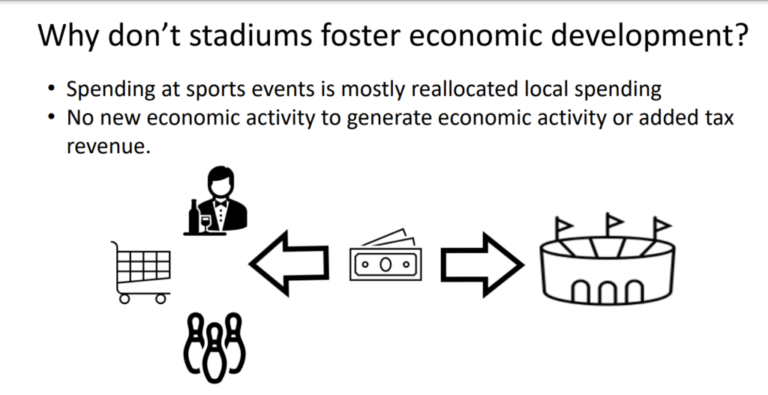

The underside line is fairly easy. Each time a sports activities crew needs a brand new venue, they’ll get folks to say out loud that the financial advantages of a brand new venue might be huge! It may possibly create new jobs! New Revenues! New Progress! Besides, analysis on this assertion has been looked at and studied repeatedly. They present that sports activities venues don’t magically enhance financial improvement close to a venue. Nor will a brand new venue miraculously generate new tax revenues. If a metropolis or state is placing huge quantities of taxpayer cash into a brand new area, ballpark, or stadium, native taxpayers would be the ones left paying the invoice…100% of the time.